40+ Debt repayment calculator multiple loans

Founded in 2014 the lender is one of our top picks for debt consolidation. You can take out a personal loan to consolidate multiple kinds of debt such as credit cards or other.

44 Effective Collection Letter Templates Samples ᐅ Templatelab Collection Letter Letter Templates Lettering

Yes its possible to get a 40-year mortgage.

. We were paying down. Repayment terms range from 36 to 60 monthsor three to five years. Can be used to consolidate debt.

Make a single monthly repayment - If you can consolidate all your debt into one place then that means one payment per month rather than several making repayment easier to manage. List up to 20 or even 40 creditors. The company has two loan periods 36 months and 60 months from which the customers need to choose.

How to pay off student loans. Universal Credit is an online lending platform that offers personal loans between 1000 and 50000 through its partners. MEFA undergraduate loans have fixed interest rates from 489 to 699 APR with multiple repayment options.

While both debt repayment methods can be effective debt snowball prioritizes paying off. To be eligible applicants must be working in their field at least 40 hours a week for a minimum of 45 weeks per year. By borrowing a loan with a fixed interest rate youll ensure stable predictable monthly payments for the life of the loan.

Download a free Debt Reduction Calculator spreadsheet and eliminate your debt using the debt snowball or other debt reduction strategies. What will my repayments be. You can compare your prequalified rates from multiple vetted lenders in just two minutes without affecting your credit.

This is due to the very short time frame given to borrowers to generate repayment. Use the calculator in your business to help advise clients. The calculator also assumes that the loan will be repaid in equal monthly installments through standard loan amortization ie standard or extended loan repayment.

For personal loans set the downpayment to 0. 40 In the event that you cant. Can you get a 40-year mortgage.

FreedomPlus is an indirect lending platform that offers personal loans underwritten by Cross River Bank or MetaBank. As with all loans debt consolidation loans also have some potential drawbacks to consider including. These rates also tend to be lower compared to other options like credit cards.

Qualifying sites must be in a designated HPSA. For this reason interest rates for bridge loans are usually higher than traditional commercial mortgages. While this calculator was originally designed for vehicle loans you can use it for any type of loan.

West Virginias State Loan Repayment Program offers student loan forgiveness for nurses practicing full time for a minimum of two years in underserved rural areas. Student loan repayment calculator. Interest rates for bridge loans are generally based on the six-month LIBOR index and a spread of 45 55 points.

Avant charges an origination fee of up to 475 if you decide to. But note that this estimate depends on. Theres no origination fee application fee or prepayment penalty.

No early termination fee. Customers with at least 7500 of unsecured debt qualify for its debt. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to.

If you wanted to use this calculator for home mortgages please keep in mind the amortization tables payment amounts will only reflect the principal and interest on the loan. Simplify existing debts - Consolidated loans can be used to pay off existing debts held with multiple lenders be that personal loans credit cards or overdrafts. While the most common and widely used mortgages are 15- and 30-year mortgages lenders can and do offer a wide variety of payment termsFor example a borrower looking to pay off their home quickly may consider a 10-year loanOn the other hand a buyer seeking the lowest.

Any delay in the repayment will result in fees and a penalty fee of 5 of the loan amount or 15 whichever is high. National Debt Relief is a debt settlement company that negotiates with creditors to decrease your overall debt. For example LightStreams overall personal loan APRs range from 399 to 1699.

Some lenders may have different terms for debt consolidation loans compared to personal loans for other purposes. Avant offers loans ranging from 2000 to 35000 with flexible repayment terms of 12 to 60 months to borrowers in 39 states. Personal loans usually have fixed interest rates which means your rate and payment will remain the same over the life of the loan.

Your loan terms are not guaranteed and are subject to our verification of your identity and credit information. Rates range from 699 to 2499 APR and loan terms range from 36 to 72. Student loan refinancing calculator.

Depending on your goal the right method can lower your monthly payments save you money on interest or get you out of debt faster. 40 lakh based on the banks eligibility criteria subject to. We have multiple rentals and so mortgage loans.

Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc. As our choice for the best overall lender for swimming pool loans LightStream promises low interest rates for pool loans starting at just 499 with a 050 autopay discount. Our multiple debt payoff calculator can help you determine the best ways to pay off debt.

The results will not be accurate for some of the alternate repayment plans such as graduated repayment and income contingent repayment. Educational Loan Minimum Monthly Payments. Typically if you have a high credit score preferably 750 and above with high paying job and low debt-to-income ratio you may be eligible for unsecured personal loans of up to Rs.

500 up until the last 3 months of the loan term. But when it comes to loans for debt consolidation specifically the minimum is 595 and the maximum is 1679. The repayment should be carried out promptly with the appropriate interest rate allotted to you for the loan amount.

Personal loan repayment calculator. Theres no need to manage multiple credit card balances or loans from multiple.

Budget Boss Binder 40 Budget Printables To Master Your Money Video Video Debt Repayment Budgeting Money Budget Printables

10 Budgeting Tips For Your Money Budgeting Tips Finance Tips Budgeting

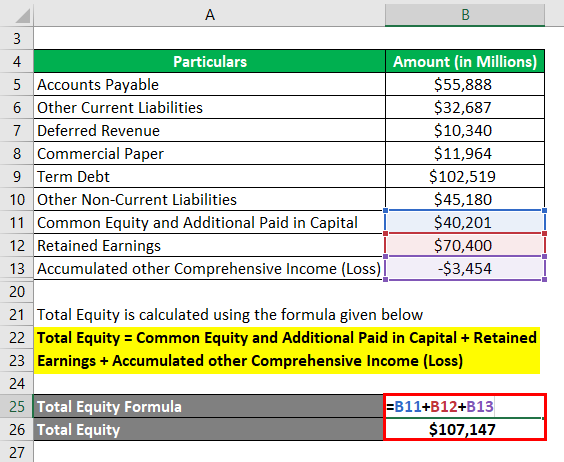

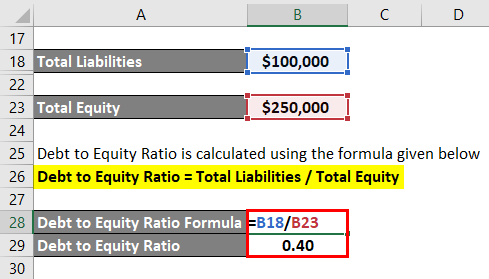

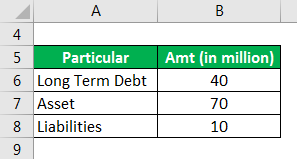

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Shop Budget Boss Binder Who Says What Video Video Debt Repayment Debt Free Budgeting

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

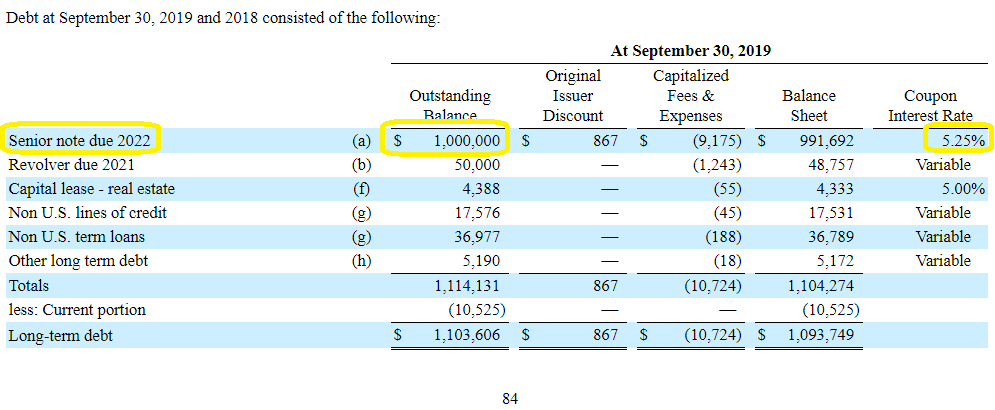

Net Debt To Ebitda Guide Risk Valuation Examples And S P 500 Data

Who Has Student Loan Debt In America The Washington Post

How We Paid Off 250 000 In Debt In 5 Years Debt Payoff Plan Debt Finance Debt

You Refinance Your Mortgage So Why Not Your Credit Card Payments With Payoff You Have Bank Level S Paying Off Credit Cards Credit Cards Debt Budgeting Money

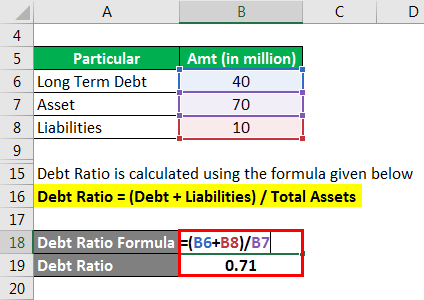

Debt Ratio Example Explanation With Excel Template

Free Debt Snowball Worksheet Crush Your Debt Faster

Tradelines 101 Infographic Tradelines Credit Card Hacks Credit Card Infographic

Payment Schedule Template Excel Beautiful 8 Printable Amortization Schedule Templates Excel Template Amortization Schedule Schedule Templates Schedule Template

Budget Boss Binder 40 Budget Printables To Master Your Money Video Video Debt Repayment Budgeting Money Budget Printables

Debt Ratio Example Explanation With Excel Template

Net Debt To Ebitda Guide Risk Valuation Examples And S P 500 Data